- #Intuit quickbooks contractor pro pdf

- #Intuit quickbooks contractor pro full

- #Intuit quickbooks contractor pro trial

#Intuit quickbooks contractor pro trial

įree trial download: The first 30 days of QuickBooks Desktop Enterprise free trial from the date of sign up is free. See Subscription Terms & Conditions for details.

Upon expiration of your paid subscription you will no longer have access to the product or any of its connected services. If you cancel outside of the 60 day money back guarantee period you will have access to QuickBooks Enterprise for the remainder of the 12 month term in which you paid for. If you cancel inside the 60 day money back guarantee period you can opt to receive a refund (see: money back guarantee terms and conditions ). Intuit will authorize your card to ensure prompt order processing, resulting in a temporary hold on your account. If you select the Monthly Option Plan then you will pay the then-current fee over the course of 12 months. You can cancel at any time by going to Account & Settings in QuickBooks and select “Cancel” or by calling 80, prior to your renewal date.īoth the Annual and Monthly Option Plan commits you to a 12-month term fees vary per plan. After 12 months, your credit/debit card account on file will automatically be charged on a monthly or annual basis at the then-current fee for the QuickBooks Desktop Enterprise product and plan you’ve selected until you cancel. Your subscription of QuickBooks Desktop Enterprise Silver, Gold or Platinum is valid for the first 12 months starting from purchase date.

#Intuit quickbooks contractor pro full

If you are not satisfied with QuickBooks for any reason, simply call 80 within 60 days of your dated receipt/purchase confirmation for a full refund of the purchase. Step 7 – Once complete, deliver the form to the company Human Resources (HR) department or directly to the employer to continue to the process of direct deposit initiation.Terms, conditions, pricing, subscriptions, packages, features, service and support options are subject to change at any time without notice.

Provide the amount (full or percentage) to be deposited into the account, if the deposit should be split between accounts.Submit your account number on the line titled “Account number”.Enter your Bank’s Routing Number in the space following the words “Bank routing number (ABA number).Mark the bubble next to the words “Account 1 type” to define whether the Account Number you are reporting is a Checking Account or Savings Account.Step 2 – Employee Direct Deposit Authorization – Review the information at the top of the page and proceed by entering the following information in the section labeled “Account 1:”

#Intuit quickbooks contractor pro pdf

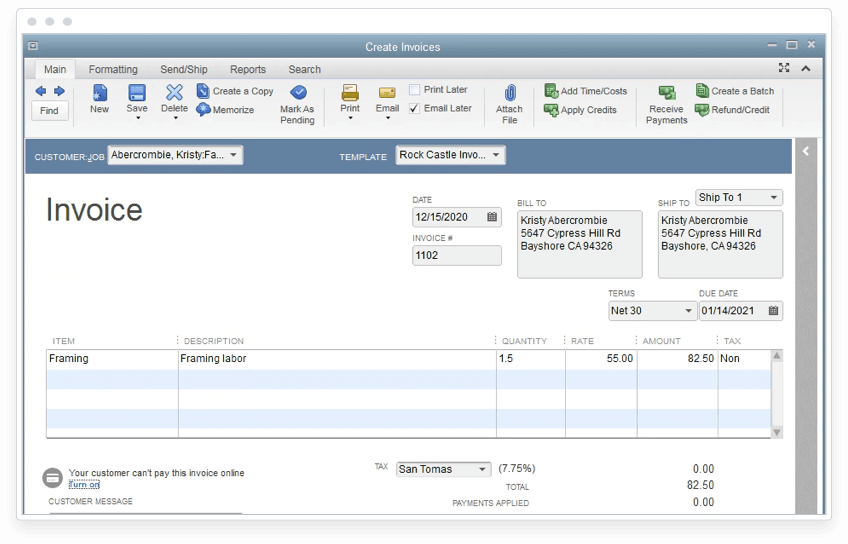

This will enable you to download the Intuit/Quickbooks Payroll Direct Deposit Form as a PDF document. Step 1 – Locate the image on the right and select the PDF button below it. Ultimately, it is left up to the Employee to consult with an Employer’s Payroll Department on what the proper procedure and paperwork required to set up Direct Deposit payments is. Many Employers who require this form may require a blank voided check to be submitted as well. Also, you will need to Name and Authorize your employer to make such deposits. You will need to decide which Account or Accounts you wish your payment to be deposited to then report the information defining the target Account(s). The Intuit (Quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit.

0 kommentar(er)

0 kommentar(er)